Key information

Publication type: The London Plan

Publication status: Adopted

Publication date:

Contents

5 sections

Town Centre Network and Future Potential Network Classification

Table A1.1 classifies London’s larger town centres into five categories: International, Metropolitan, Major and District centres, as well as CAZ retail clusters. In addition, there are Local and Neighbourhood centres throughout London, which may be designated in Local Plans. This classification provides a hierarchy, recognising the different size and draw of town centres. Table A1.1 also identifies those centres that may have the potential to be re-classified in the future (see Policy SD8 Town centre network). The different roles in the network are:

- International centres – London’s globally-renowned retail and leisure destinations, providing a broad range of high-order comparison and specialist shopping, integrated into environments of the highest architectural quality and interspersed with internationally-recognised leisure, culture, heritage and tourism destinations. These centres have excellent levels of public transport accessibility.

- Metropolitan centres – serve wide catchments which can extend over several boroughs and into parts of the Wider South East. Typically they contain at least 100,000 sqm of retail, leisure and service floorspace with a significant proportion of high-order comparison goods relative to convenience goods. These centres generally have very good accessibility and significant employment, service and leisure functions. Many have important clusters of civic, public and historic buildings.

- Major centres – typically found in inner and some parts of outer London with a borough-wide catchment. They generally contain over 50,000 sqm of retail, leisure and service floorspace with a relatively high proportion of comparison goods relative to convenience goods. They may also have significant employment, leisure, service and civic functions.

- District centres – distributed more widely than Metropolitan and Major centres, providing convenience goods and services, and social infrastructure for more local communities and accessible by public transport, walking and cycling. Typically, they contain 5,000–50,000 sqm of retail, leisure and service floorspace. Some District centres have developed specialist shopping functions.

- CAZ retail clusters – significant mixed-use clusters located within the Central Activities Zone, with a predominant retail function and, in terms of scale, broadly comparable to Major or District centres. See Policy SD4 The Central Activities Zone (CAZ).

- Local and Neighbourhood centres – typically serve a localised catchment often most accessible by walking and cycling and include local parades and small clusters of shops, mostly for convenience goods and other services. They may include a small supermarket (typically up to around 500 sqm), sub-post office, pharmacy, laundrette and other useful local services. Together with District centres they can play a key role in addressing areas deficient in local retail and other services. This includes locally-identified CAZ retail clusters.

Figure A1.1 - Future Potential Changes To The Town Centre Network

Night-time Economy Classification

These centres have a strategic night-time function involving a broad mix of activity during the evening and at night, including most or all of the following uses: culture, leisure, entertainment, food and drink, health services and shopping. (See Policy HC6 Supporting the night-time economy) and Figure 7.6 for details. They are classified into three categories:

- NT1 – Areas of international or national significance

- NT2 – Areas of regional or sub-regional significance

- NT3 – Areas with more than local significance

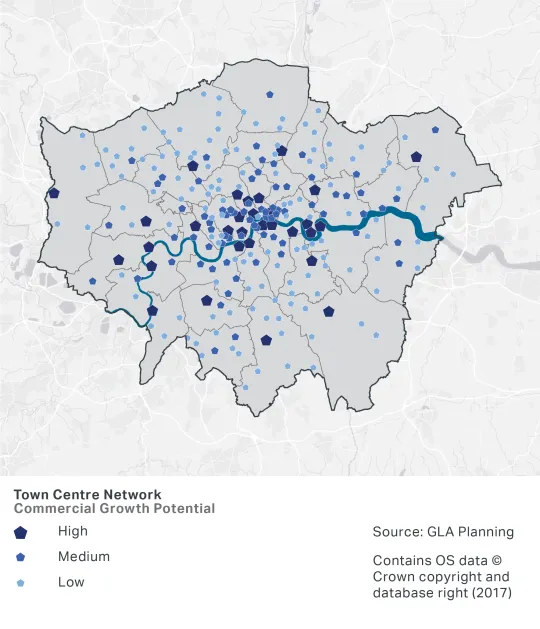

Commercial Growth Potential

Table A1.1 provides strategic guidance on the broad future direction envisaged for the International, Metropolitan, Major and District centres and CAZ retail clusters including their possible potential for commercial growth (uses falling within the A, B, D and SG Use Classes). Three broad categories of future commercial growth potential have been identified:

- High growth – includes town centres likely to experience strategically-significant levels of growth with strong demand and/or large-scale retail, leisure or office development in the pipeline and with existing or potential public transport capacity to accommodate it (typically PTAL 5-6).

- Medium growth – includes town centres with moderate levels of demand for retail, leisure or office floorspace, and with physical and public transport capacity to accommodate it.

- Low growth – town centres that are encouraged to pursue a policy of consolidation by making the best use of existing capacity, either due to (a) physical, environmental or public transport accessibility constraints, or (b) low demand.

Figure A1.2 - Town Centre Growth Potential – Commercial

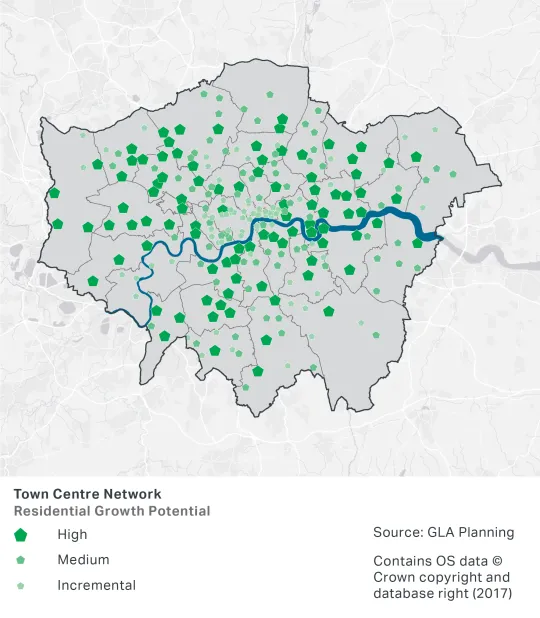

Residential Growth Potential

All town centres have potential for residential growth, either within or on the edge of the town centre. Table A1.1 provides strategic guidance for the relative potential for residential growth for the International, Metropolitan, Major and District centres and CAZ retail clusters, indicating whether they would be likely to be able to accommodate high or medium levels of residential growth, or incremental residential development. This is a broad strategic-level categorisation that has been informed by the SHLAAA[A1] and Town Centre Health Check, and takes into consideration the potential for impacts on heritage assets. Boroughs should be planning proactively to seek opportunities for residential growth in and around town centres, in particular using the mechanisms set out in Policy SD7 Town centres: development principles and Development Plan Documents, informed by detailed assessments of town centre capacity and complementing approaches set out in town centre strategies.

Figure A1.3 - Town Centre Growth Potential – Residential

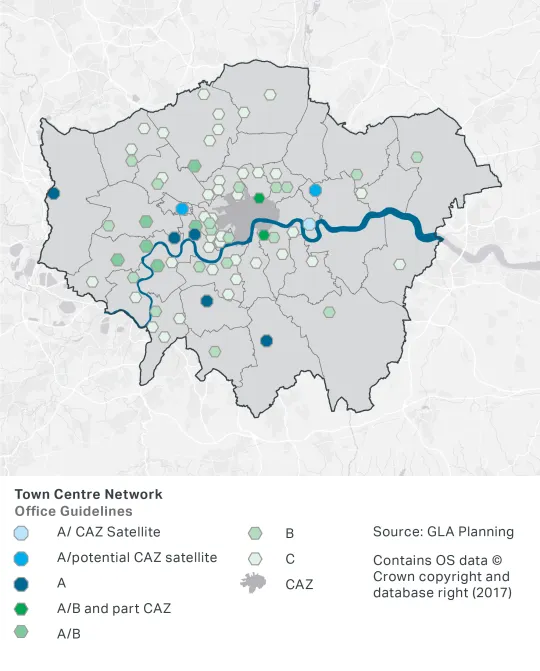

Office Guidelines

Table A1.1 and Figure A1.4 set out those town centres where specific approaches to offices are recommended, as informed by the London Office Policy Review[A2] and borough evidence.

CAZ – Centres in the Central Activities Zone with a significant office function. See Policy SD4 The Central Activities Zone (CAZ) and Policy SD5 Offices, other strategic functions and residential development in the CAZ.

CAZ Office Satellite – The Northern Isle of Dogs (NIOD) currently functions as a CAZ satellite in terms of office provision. Stratford and Old Oak Common will share the hyper-connectivity of the CAZ and could have the potential to function as future CAZ satellites, should the demand for office floorspace exceed the capacity of the CAZ and NIOD.

A. Speculative office potential – These centres have the capacity, demand and viability to accommodate new speculative office development.

B. Mixed-use office potential – These centres have the capacity, demand and viability to accommodate new office development, generally as part of mixed-use developments including residential use.

C. Protect small office capacity – These centres show demand for existing office functions, generally within smaller units.

Figure A1.4 - Town Centre Office Guidelines

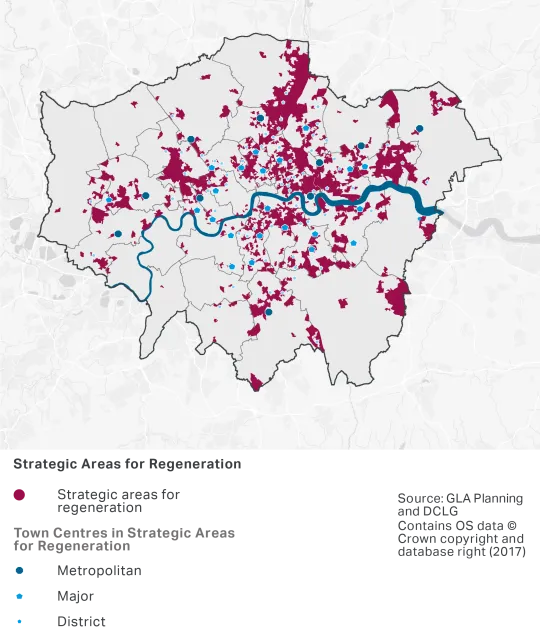

Figure A1.5 - Town Centres Within Areas For Regeneration

Table A1.1 - Town Centre Network

Centres with Night-time Economy classification only

Centres with Future Potential Network classification only

* This classification refers to those town centres that are within or overlap with the Strategic Areas for Regeneration (see Policy SD10 Strategic and local regeneration).